We're Pomelo

The first financial technology platform to combine consumer credit and remittance transfer

Today I am very excited to unveil Pomelo, a new way to send money around the world with credit that crosses borders, with a mission to change how international money transfer fundamentally works.

Pomelo is the first financial technology platform to combine consumer credit and remittance transfer. In partnership with Mastercard, Pomelo has developed a new type of credit card with unique features that allows our customers in the United States to extend and allocate credit to their loved ones around the world. By empowering customers to share spending power instead of sending cash, we hope to solve the worst aspects of money transfer: the exorbitant fees, the long waits, and the universal concern about funds in flight, that loved ones make it home safe carrying those funds and spend it wisely.

Most important of all, we aim to help our customers establish their financial future here in the United States by building positive credit history with their existing remittance obligations, and to financially include their loved ones in emerging economies with access to modern financial instruments. For many of our customers, Pomelo is their first credit card here in the US and the very first card for their loved ones overseas.

How Pomelo Started

As someone who has firsthand experience with the problems of money transfer (my family regularly sends money to relatives in the Philippines), the idea for Pomelo emerged during an extended visit to Cebu right before the pandemic. I was on sabbatical after founding and running a database technology startup called Singlestore for 7 years, and I had finally relearned how to let my mind wander.

It was a small but interesting observation that for the first time, I hadn’t used cash at all in the Philippines. Point-of-sale (POS) terminals and smartphone-based card readers were common in stores and restaurants, taxis accepted digital payment with Grab, and I could even pay a hospital bill with my card as well.

With more and more merchants accepting cards and with ecommerce ecosystems rapidly growing everywhere, I asked myself,

“Why can’t I just give a card to my family instead of having to send money through Western Union?”

Quite simply, I started Pomelo to answer that question.

A Large Market in Need of Innovation

Remittance transfer is a massive market, a $600 billion per year sector of the global financial economy, but one that has not kept pace with the rate of innovation seen in other categories like neobanking or mobile money.

In the year 2022, fees remain high and the customer experience is poor: globally, remitters lose an average of 6%1 per transfer to fees while their recipients can often wait hours or days for funds to be made available, only to then visit unhappy places like pawnshops to pick up loose bills and coins. For so many millions of people around the world, this is a ritual quietly endured and repeated once or twice a month, year in, year out.

Most money transfer operators accept a variety of payment options, including Visa and Mastercard, as funding instruments. But, what if, instead of treating interchange as a cost center, the remittance company turned it into a revenue source? Better yet, what if there was no actual money to send at all?

By using credit card payment rails for the first time as a means of disbursement, it’s now possible to realize what was previously an impossible goal: zero transfer fees.

The Power of Pomelo

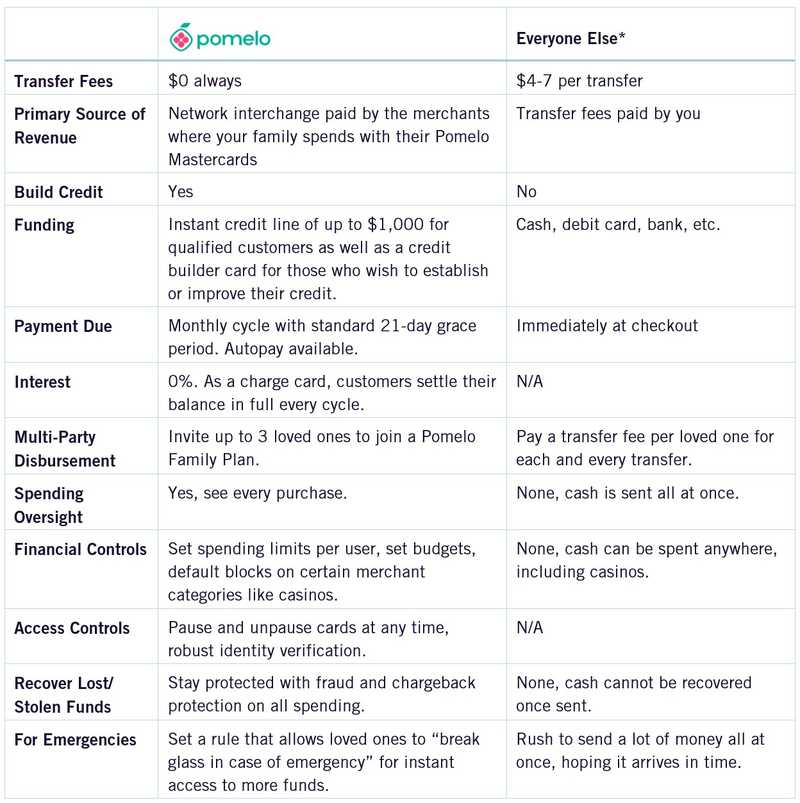

By combining credit card mechanics with remittance transfer, our goal is to deliver a product experience that is familiar to most American consumers yet creates new outcomes and substantial savings:

Realizing a Cashless Future

Pomelo is incredibly well-suited for those with family in or near metro areas to access merchants that accept Visa and Mastercard as well as for those who can shop online at e-commerce sites like Lazada and others.

Of course, we understand that for many consumers in emerging economies and for those who live in more rural areas, cash is still king and needed to shop at wet markets and mom-and-pop businesses like sari-sari stores, etc. However, we believe that global urbanization and migration patterns are trends that will ultimately help realize a cashless future in more parts of the world. For example, already in the Philippines, one can find an SM or Robinson’s mall in most provinces, each with hundreds of stores with POS capabilities at checkout. While no single financial instrument can do it all, Pomelo addresses a substantial portion of the remittance needs for our customers today.

Official Launch of our First Corridor

Our team has been hard at work these past 24 months to build the complex infrastructure needed to create not just a new product, but to spearhead a new product category. After having devoted the last several months to private beta testing, today I’m pleased to officially launch Pomelo with the Philippines! In the 6 months prior to the beta, more than 120,000 people joined our waitlist, and we will be unlocking more of the waitlist in the coming months as we expand operations and prepare to launch into new countries.

Announcing our Funding

I’m also incredibly excited to announce our Series Seed of $20m in venture capital and $50m in credit facility for a total of $70m in seed financing. Keith Rabois, General Partner, at Founders Fund and Kevin Hartz, Co-Founder of Xoom and General Partner, at A* Capital led the round with Anamitra Banerji and Gaurav Jain at Afore Capital, Josh Buckley at Hyper, Patrick Chung and Brandon Farwell at Xfund, Alex Pall and Andrew Taggart aka The Chainsmokers at MantisVC, and Abel Tesafaye aka The Weeknd, also investing in the round.

What’s Next

In the coming years, we look forward to “planting more Pomelo trees” across the more than 210 countries where Mastercard is accepted. We are incredibly excited to have you join us in this journey to bring families everywhere closer together.

-Eric

Founder and CEO